Embarking on your journey into the realm of cryptocurrencies can be both thrilling and daunting. With the crypto market constantly evolving, knowing where to start is essential for success. Whether you’re a newcomer intrigued by the potential or a seasoned investor seeking new opportunities, this guide will equip you with the knowledge and tools to navigate the crypto landscape effectively.

Understanding Crypto Basics

Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual currencies that utilize cryptography for security. Here, we’ll explore the fundamental concepts that form the backbone of the crypto world.

Cryptocurrencies operate on decentralized networks called blockchains, which record all transactions transparently and securely.

The Role of Blockchain Technology

Blockchain technology serves as the foundation of cryptocurrencies, enabling peer-to-peer transactions without the need for intermediaries like banks.

Blockchain networks consist of blocks containing transaction data, which are linked together in chronological order, forming a chain.

Key Features of Blockchain

- Decentralization: Unlike traditional banking systems, blockchain networks are decentralized, meaning they are not controlled by any single entity.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted, ensuring transparency and security.

- Security: Cryptography ensures the integrity and security of transactions on the blockchain, making it resistant to fraud and tampering.

Choosing the Right Cryptocurrency

With thousands of cryptocurrencies available, selecting the right one can be overwhelming. Here’s a guide to help you navigate the options and make informed decisions.

Factors to Consider

When choosing a cryptocurrency to invest in, consider the following factors:

- Market Cap: The total value of a cryptocurrency’s circulating supply, indicating its size and potential for growth.

- Technology: Assess the underlying technology and use case of the cryptocurrency to determine its long-term viability.

- Community and Development: A strong community and active development team are indicators of a healthy cryptocurrency project.

- Risks and Volatility: Understand the risks and volatility associated with each cryptocurrency, and only invest what you can afford to lose.

Popular Cryptocurrencies for Beginners

- Bitcoin (BTC): As the first and most well-known cryptocurrency, Bitcoin remains a popular choice for beginners due to its established reputation and widespread adoption.

- Ethereum (ETH): Ethereum is renowned for its smart contract functionality, enabling developers to build decentralized applications (DApps) on its blockchain.

- Litecoin (LTC): Often referred to as the “silver to Bitcoin’s gold,” Litecoin offers faster transaction times and lower fees compared to Bitcoin.

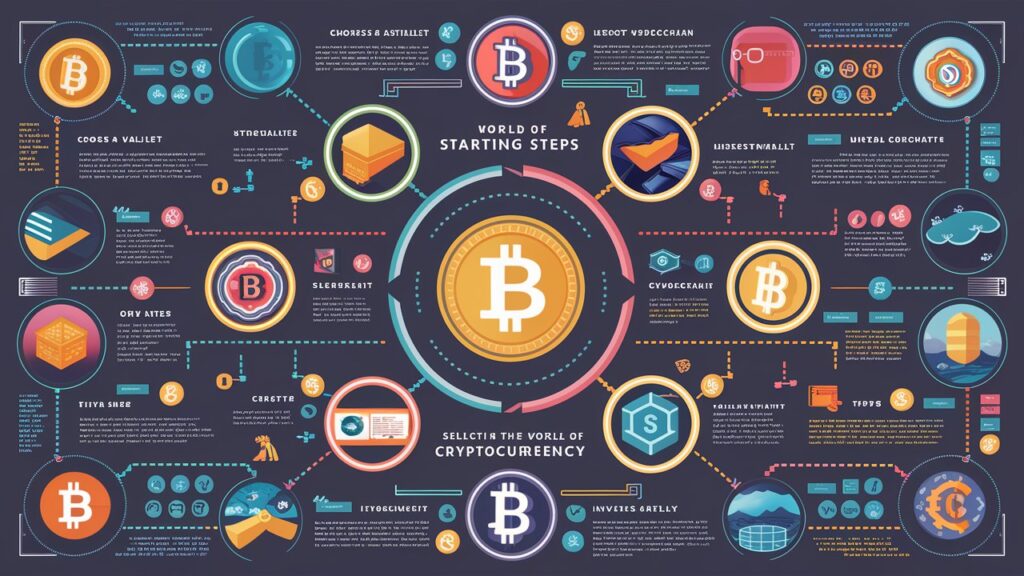

Getting Started with Crypto Investments

Now that you have a basic understanding of cryptocurrencies, let’s explore how to get started with your investment journey.

Setting Up a Cryptocurrency Wallet

Before you can start investing in cryptocurrencies, you’ll need to set up a digital wallet to store your assets securely.

FAQs (Frequently Asked Questions)

1. How do I buy cryptocurrencies? To buy cryptocurrencies, you can use a cryptocurrency exchange platform such as Coinbase, Binance, or Kraken. Sign up for an account, complete the verification process, and deposit funds to begin trading.

2. Is cryptocurrency investment risky? Yes, cryptocurrency investment carries inherent risks due to market volatility and regulatory uncertainties. It’s essential to conduct thorough research and only invest what you can afford to lose.

3. Can I mine cryptocurrencies? Mining cryptocurrencies involves verifying and adding transactions to the blockchain through computational power. While it’s still possible to mine certain cryptocurrencies, it requires specialized hardware and significant electricity consumption.

4. How do I secure my cryptocurrency investments? To secure your cryptocurrency investments, use best practices such as enabling two-factor authentication (2FA), storing your private keys offline, and diversifying your portfolio.

5. What are the tax implications of cryptocurrency investments? Cryptocurrency tax regulations vary by country. In general, you may be subject to capital gains tax on profits from cryptocurrency investments. Consult with a tax professional to ensure compliance with local regulations.

6. How can I stay updated on crypto market trends? To stay informed about crypto market trends, follow reputable sources such as cryptocurrency news websites, forums, and social media channels. Additionally, join online communities and attend blockchain conferences to network with industry professionals.

Conclusion

Embarking on your crypto journey can be a rewarding endeavor, but it’s essential to approach it with caution and diligence. By understanding the basics, choosing the right cryptocurrencies, and adopting sound investment strategies, you can navigate the crypto landscape with confidence. Remember to stay informed, stay vigilant, and always conduct thorough research before making investment decisions.